3 MIN READ

The 5 Things Auto Insurance Companies Do Not Want Drivers to Know in 2025

More and more Your State drivers unaware they are paying too much for auto insurance

ADS SEEN ON

Your State DRIVERS: Insurance agent confirms most are overpaying for auto insurance and reveals the “insider tricks” drivers can use to lower their rates. Speaking on the condition of anonymity, the longtime agent stated that insurance companies “profit off drivers being in the dark,” and count on “unwitting customers to keep paying grotesquely high rates from bank accounts set on autopilot.”

The agent continued, “as an insider, I can tell you there are some simple tricks, including a new independent website, that drivers need to try immediately to break the cycle of throwing away their hard-earned money.” The agent added, “but the insurance companies do not want to let the cat out of the bag.”

Some members of our staff decided to take the below “insider tricks” and the recommended website for a test drive. When Terri entered her zip code into BigSavingsCarInsurance.com, she was shocked at what came back. Within seconds, she had five different options, with the top two offering prices significantly less than what she was currently paying:

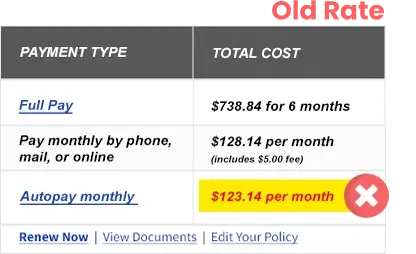

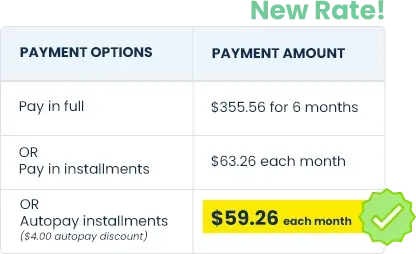

“I was amazed. After entering some basic info, I saw a list of ten results in an instant. The site suggested a top choice to me, so I clicked it and saw my quote. Wow! My monthly rate dropped from $123 to $59, for pretty much the same coverage. That is almost $800 in savings for the year! I honestly didn’t expect this good of a result. It was a no brainer to switch, I just wish I knew about it sooner!” - Terri

Other staff members who tried the website also saw savings over their current rates, mostly in the range of 30% to 60%. The consensus was that the agent was on to something seeing how our own team was overpaying without realizing it.

Here are the “simple tricks” the agent disclosed:

- Drive Under 50 Miles Per Day

Insurance companies set rates based on a driver’s annual mileage. Generally, the more miles you drive, the higher your rate. And these days, many are spending significantly less time traveling and commuting because of the COVID-19 pandemic.

However, according to the agent, “an obscenely high number of auto insurance policies are still priced at the higher annual mileage of pre-pandemic driving habits.”

In other words, many people are paying a higher rate, one that is based on miles they no longer drive. You should make sure that your current policy reflects your actual mileage. It turns out that rates can drop significantly if you drive less than 50 miles per day.

- Sync Your Record and Policy

Insurance companies have no problem raising rates when drivers get tickets or accidents. However, the agent revealed that insurers “drag their feet and are not obligated to lower rates once driving violations are off [your] record.”

For this reason, it is important to first obtain a copy of your driving record from your state, and then check your policy. If your policy still has your driving violations factored in, then it is probably time to switch.

The same scenario can be true for drivers who had a DUI. Though DUIs are with you longer than a ticket or accident, once off your rate should drop substantially. As with the above, make sure your policy aligns with what is currently on your driving record.

Similarly, drivers who at one point had a gap in coverage should also be on alert for potentially missing out on lower rates. Many insurers charge more to cover an uninsured driver. Yet, after a year of continuous coverage, the higher rate is no longer warranted. If the gap in your coverage was closed 12 months ago or longer and you have yet to see a rate decrease, now is a good time to switch.

- Make Sure Your Insurer Specializes in Your Driver Type

It is important that your driver type matches with your insurance company’s specialty, otherwise you are setting yourself up to pay unnecessarily high rates.

If you have a bad driving record, are uninsured, or are a new or teen driver, you can avoid overpaying by going with a company that specializes in what are known as “non-standard drivers.” The inverse is also true. If you have a good driving record, credit score, and coverage history, then make sure you go with an insurer that specializes in “standard drivers.” If there is a mismatch, expect to pay more.

You can use this website to find insurers that match your driver type.

- You Are Not Locked into Your Current Policy

Some drivers know they are overpaying but think they must wait until their policy expires to switch to a new one. Do not do that.

It turns out drivers are never locked into their current policy. They can switch to another company any time. If you paid in advanced, your current insurer should refund you for the unused amount of your term.

According to the agent, “insurers love customers who think they are locked into their policy term. Combined with auto renew, people end up almost perpetually overpaying because they have trouble timing a deadline that simply does not exist.”

Avoid getting stuck in this cycle by switching companies today.

- Shop Around Often

Per the agent, “loyalty tends to benefit insurers, not drivers.” It turns out that rates change often for new customers, so it is a good idea to shop around every three months.

The agent also said that “insurers benefit from the fact that comparison shopping can be difficult and time consuming.” When asked for a solution, the agent emphasized: “The last thing they want is for drivers to find out about sites like BigSavingsCarInsurance.com and other tools that make it easy to quickly find the right company with the lowest rates.”

How You Can Save Too

The comparison site, along with the agent’s other recommendations, should be able to save you around 30% to 60%, as that was the case for most of our staff. Here is how to get started with the site, and what to expect:

- Step 1: Enter your zip code below. This will take you to directly to the next step of the site.

- Step 2: Answer a few basic questions. No personal info is required. The site uses these answers to match you the most relevant results.

- Step 3: Compare quotes. Select view rates of your top choice and at least one more result to compare. Choose the best quote and start saving!

Verdict: These auto insurance “tricks” deserve to be a Big Savings Car Insurance